As Macy’s continues working to stabilize its brick-and-mortar operations, the company reported a drop in comparable store sales in the first quarter.

For the 13-week period ended April 29, sales decreased 7.5% to $5.338 billion. Company officials said the decline in sales, in part, reflects previously announced store closings. Comparable store sales on an owned basis were down 5.2%.

Operating income totaled $220 million or 4.1% of sales, compared to $276 million or 4.8% of sales for the same period in 2016. Diluted earnings per share for the first quarter were $0.23, compared to $0.37 in the first quarter the previous year.

“Our first quarter sales and earnings results were consistent with our expectations, and we remain on track to meet our 2017 guidance,” said Jeff Gennette, president and CEO of Macy’s. “We are encouraged by the performance of the pilot programs we tested last year in categories like women’s shoes, fine jewelry, and furniture and mattresses.”

He noted that the company’s digital platforms showed continued strong growth in the first quarter, adding that the company is focused on taking actions to stabilize its brick-and-mortar business.

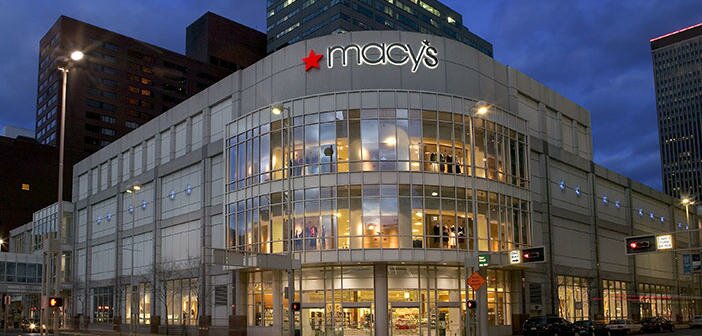

The company in the first quarter received cash proceeds associated with real estate transactions of $96 million and booked $68 million of real estate gains. Of these gains, $47 million were related to the sale of the company’s downtown Minneapolis property.

Macy’s is also under contract to sell two additional floors of its downtown Seattle store after having sold floors five through eight in 2015. This transaction is expected to close in fall 2017.

During the first quarter, the company opened new Macy’s stores in Murray, UT, and Los Angeles, as well as 10 new freestanding Bluemercury beauty specialty stores and 11 new Macy’s Backstage stores within existing Macy’s stores. Additionally, one Bloomingdale’s store opened in Kuwait under a license agreement with Al Tayer Group.

Looking ahead, Macy’s affirmed its previously provided guidance for full-year 2017. The company expects comparable sales on an owned basis to decline between 2.2% and 3.3%, with comparable sales on an owned plus licensed basis to decline between 2% and 3%. Total sales are expected to be down between 3.2% and 4.3% in fiscal 2017.