Restoration Hardware (RH) touted its transformation efforts in the first quarter, reporting a narrower net loss and a jump in sales.

For the three months ended April 29, Restoration Hardware posted a net loss of $3.4 million, or nine cents per diluted share, versus a net loss of $13.5 million, or 33 cents per diluted share, in the year-prior period. Adjusted net income was $1.8 million, or five cents per diluted share, versus a net loss of $2.1 million, or five cents per diluted share, in the period a year earlier. Adjusted earnings per share paced a MarketBeat-published analyst average estimate.

Comparable revenues increased 9% in the quarter year over year. Net revenues were $562.1 million versus $455.5 million in the fiscal year previous. Operating income was $6.9 million versus an operating loss of $11.5 million in the previous period.

Gary Friedman, Restoration Hardware chairman and CEO, maintained that 2017 is off to a strong start with first quarter net revenues increasing 23%, of which approximately six points of growth was due to the acquisition of Waterworks and six points was related to higher outlet and warehouse sales stemming from accelerated inventory optimization efforts. Excluding those factors, Restoration Hardware grew by approximately 11%, with comparable revenues gaining 9% as the company cycled the launch of its RH members program, and benefited from the mailing of the fall 2016 RH Interiors Source Book and of the spring 2017 RH Outdoor catalog. Although higher outlet sales and inventory optimization efforts had a positive impact on first quarter revenues, those sales plus related markdowns and inventory reserves had a negative impact on margins and earnings, according to Friedman.

Restoration Hardware is past the more difficult part of its transformation from a promotional to a member-based business model, Friedman insisted, one established to enhance the retail brand, streamline operations and improve customer experience.

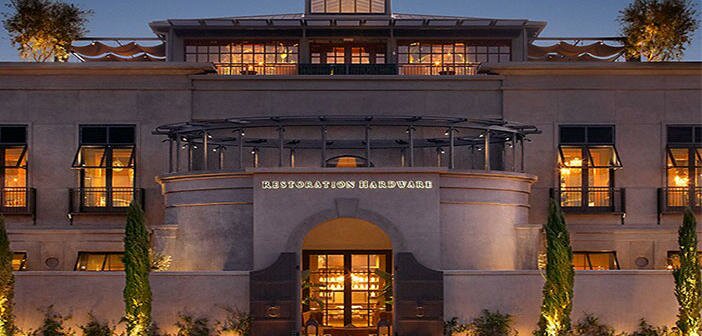

Friedman pointed out that RH has launched multiple new business initiatives over the past two years such as RH Modern, RH Teen and RH Hospitality as well as redesigning its RH Interiors Source Book, rolling out design ateliers in its galleries stores, and added Waterworks, all of which should contribute to growth in 2017 and beyond, he suggested.

In 2017, Friedman indicated, RH will focus on execution, architecture and cash. The retailer will execute against the new business model, conduct business on a new-architecture platform and maximize cash flow by increasing revenues and earnings while reducing inventory and capital investments. It will invest in RH Hospitality as the company rolls out integrated food and beverage experiences. The effort will incur substantial start-up costs, Friedman added, but will build on RH’s success in blurring the lines between residential and retail. The next logical step, he related, is to erode the lines between home and hospitality by integrating cafes, wine vaults and coffee bars into RH galleries. In addition, RH will debut galleries this year in Toronto, Palm Beach and New York.